Coping With Crisis

Though a decade has passed since the 2008 global financial crisis, the world has not fully emerged from its shadow. Instead of aiding the weak economy to recover, the policies adopted by Western countries have created new hidden perils and sowed the seeds for another financial crisis.

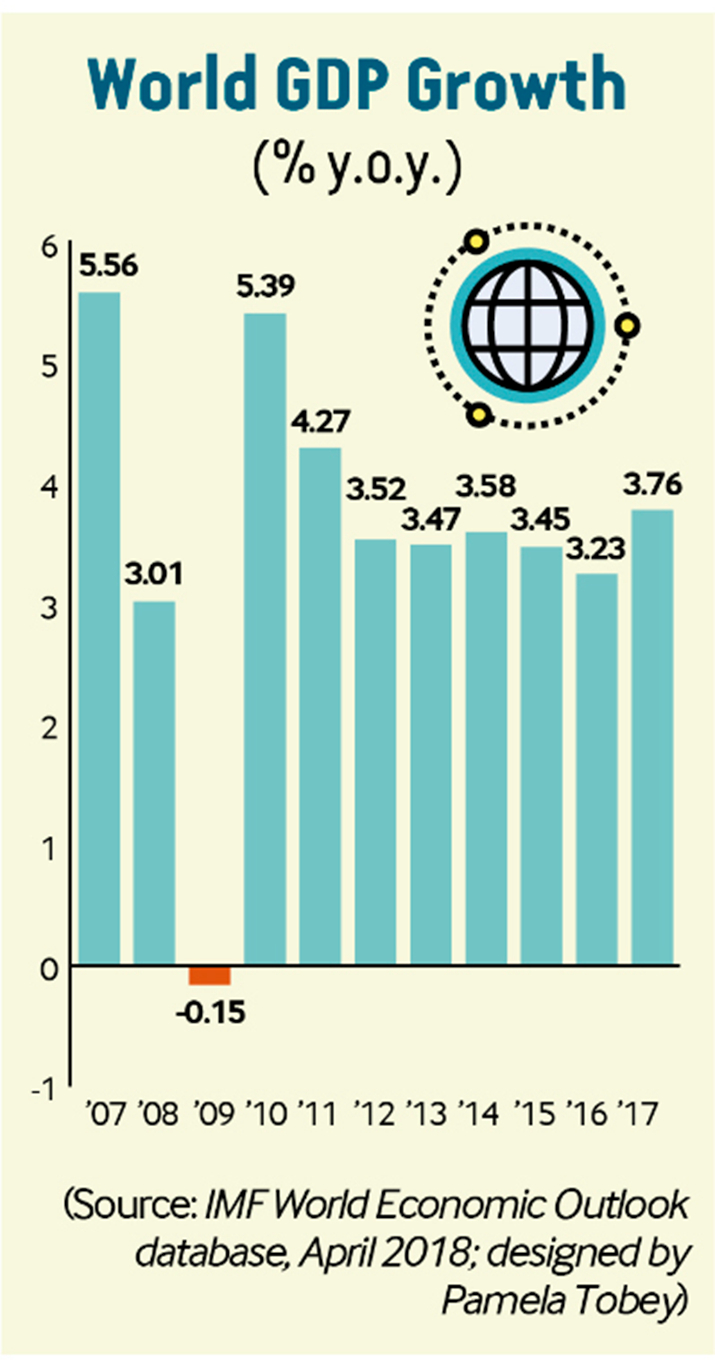

Worse still, the domino effect of the 2008 global crisis is still alive and is affecting emerging markets and developing economies, resulting in a protracted downturn in the world economy. The economy shortly rebounded in 2009, then entered a period of slow growth dubbed a “new mediocre” by International Monetary Fund (IMF) chief Christine Lagarde, with the growth rate stuck at 3.5 percent.

Δ Demonstrators call for banking reform at a rally to mark the 10th anniversary of the 2008 financial crisis, outside the Royal Exchange building in London, Britain, on September 15 (VCG).

In 2017, it rebounded from recession again, with an actual growth of 3.76 percent. The IMF expects global growth to tick up to 3.9 percent this year and next. But despite the upswing, the favorable conditions will not last for long, and the growth would inevitably bend toward a weaker longer-term level. In fact, the growth in recent years benefited mainly from stimulus policies; the cornerstone of economic endogenous growth is still fragile.

Lurking threats

The 2008 financial crisis began in the United States. The subprime mortgage crisis (2007-09) which originated on Wall Street swept the world and developed into a full-blown international banking crisis with the collapse of many financial giants such as Lehman Brothers, one of the largest investment banks in the United States.

Then came the European debt crisis climax in 2010. It was not until August this year that the EU announced the conclusion of its bailout programs for Greece, marking a temporary end to the crisis.

The third crack was the crisis in emerging markets. Emerging markets and developing economies have experienced declines year by year since 2011, with the annual growth rate falling from 6.3 percent to 4.1 percent in 2016.

The United States’ monetary policy normalization plan starting from 2014 was the prelude to the financial crisis in emerging markets and developing economies. Russia, Brazil and South Africa, bearing the brunt of it, suffered a sharp downturn, and even negative growth. As the U.S. Federal Reserve (Fed) accelerates efforts to hike interest rates and shrink its balance sheet, financial markets in more countries such as Argentina, Venezuela, Turkey and Indonesia have also fallen sharply this year.

As of September, the MSCI Emerging Markets Index had plunged by more than 9 percent, and emerging markets’ currencies had depreciated sharply.

Due to developed countries tightening their monetary policy, led by the United States and the EU, the deluge of cheap funds—money that can be borrowed at a very low interest rate—in the past few years began to outflow, creating unprecedented pressure for emerging markets and developing economies.

Δ U.S. Federal Reserve Chairman Jerome Powell testifies before the Senate Banking Committee in Washington, DC on July 17, indicating that the central bank is to keep gradually raising the federal funds rate (XINHUA).

SOS policies

In the face of the unprecedented financial crisis, governments have implemented rescue programs and stimulus policies to promote financial stability and economic growth. Both direct and indirect assistance has been given to financial institutions and enterprises in trouble. The Fed, for example, decided to bail out the American International Group, a multinational insurance and finance corporation, with $85 billion. It also provided hundreds of billions of dollars as capital injections, and kept promoting mergers and acquisitions of beleaguered financial institutions, increasing fiscal expenditures and monetary stimulus and expanding the aggregate demand.

Statistics indicate that the central banks of the United States, the EU, Japan and the United Kingdom pumped more than $13 trillion into the global economy from 2009 to 2018. They also cut their benchmark interest rates to zero or even to a negative value. To cope with the crisis, governments reexamined their financial systems, improved regulatory systems, and reorganized and upgraded their risk-control mechanisms. International cooperation was enhanced and global financial governance strengthened, improving the world financial security network.

Those measures and actions on economic and financial reconstruction, to some extent, tackled the critical situation. They stabilized market confidence, prevented bankruptcies of more financial institutions and saved the crisis from worsening with a repetition of the economic collapses that occurred in the 1930s. The world economy staged a temporary rebound. The annual GDP growth rate, which dropped sharply to -0.15 percent in 2009, achieved a sharp rebound of 5.4 percent the next year.

Those measures also helped plug the loopholes in the global financial regulatory system and boosted innovation in policymaking. Countries and international financial institutions strengthened their financial rectification and upgraded bank supervision rules (e.g. Basel III, the internationally agreed measures formulated by the Basel Committee on Bank-ing Supervision in response to the 2007-09 crisis). They also increased the capital ratio, liquidity coverage and leverage ratio of banks, and restructured and adjusted the financial stability mechanism.

Δ Central bank officials of Turkey and Qatar attend the signing ceremony of a currency swap agreement in Doha, Qatar, on August 19 (VCG).

For example, central banks such as the Fed and the Bank of England have increased their role in maintaining financial stability, established financial regulatory agencies and improved micro- and macro-prudential regulation systems. New international platforms such as the G20 have been established and currency swaps are more commonly conducted among major central banks. Governments have made joint efforts to rebuild the global financial governance system and reform the existing international monetary system.

However, those measures have merely slowed down the process or changed the manifestation of the crisis, leaving the deep-seated problems unresolved. Large-scale bailouts and fiscal and monetary stimulus policies, instead of dealing with the cause, only addressed the symptoms of the crisis. The structural problems became even worse.

One of the root causes of the financial crisis is economic inequality and the growing polarization between the rich and the poor. Ironically, the international community used a large amount of taxpayers’ money to aid the culprits that caused the crisis—financial institutions. Financial resources that should have been used to improve people’s livelihood were squandered on those institutions, while bubbles in stocks, bonds and real estate led to the widening of income disparity.

As one problem was resolved, another one cropped up. Private equity funds, hedge funds, insurance institutions, wealth management companies and other non-bank financial institutions took advantage of governments focusing on strengthening regulation for banks. The absence of regulatory rules for them brought about new perils. Then, Internet finance developed rapidly and without strict supervision, bringing new risks as well.

Today, major global stock indexes and the prices of real estate and other assets have reached a record high. The leverage ratios of households and enterprises are high. The household leverage ratio in South Korea has hit 94.6 percent, while the ratio of non-financial companies in the United States is as high as 250 percent. Global debt surged to nearly $250 trillion in June 2018 from $70 trillion in 2007, three times the global GDP. Any of these could trigger another financial crisis.

The global capacity to cope with crisis, however, has been weakened as the fiscal stimulus policies have brought governments high deficits and debts. At the same time, the central banks have adopted policies including large-scale quantitative easing, low interest rates and the inflation of the balance sheet, all of which together have greatly impacted their policy flexibility.

Losses and lessons

The impacts of the 2008 crisis have been far-reaching, reshaping the global landscape. While developed economies face heavy economic setbacks and a decline in their international influence, the emerging markets and developing economies are rising rapidly to become the main driving force for the development of the world economy. The North and the South are witnessing a historic shift toward an economic balance.

The crisis also reversed the trend of globalization. It stunned neoliberalism and caused major changes in the attitudes of the elite and people at the grassroots toward globalization. A potential disintegration of the consensus on which globalization is based will see the emergence of nationalism, populism and protectionism.

The crisis is also a factor in the restructuring of the world economy. A reflection of the global economic imbalance and overcapacity, it will promote the rebalancing of the world economy and mark the beginning of another long cycle of world economic development in the post-industrialization era.

The 2008 crisis has deep implications for China’s ongoing efforts to ensure substantial risk prevention and achieve economic transformation. China should deepen its economic structural reform. The fiscal and monetary policies are conducive to combating external shocks and maintaining short-term stable development of the economy. However, given the worldwide overcapacity, China must continue to promote structural reforms, gradually eliminate the polarization between the rich and the poor, reduce corporate debts, and rationalize the relationship between the government and enterprises. Only this way can it achieve rapid development and prosperity.

China should improve its financial regulation system and risk prevention mechanism. The financial crisis cannot be eliminated but can be prevented. A well-coordinated supervision of banks and non-bank financial institutions should be ensured and the combination of micro-regulation and macro-prudential supervision improved to resolve systemic risks.

China should embrace and lead a new type of globalization. Globalization is going through a period of adjustment and transition. It is essential to grasp the latest developments in technology and the neo-industrial revolution and take the lead to promote the reform of global financial governance.

The author is an associate researcher with the China Institutes of Contemporary International Relations

Source: Beijing Review

Facebook

Facebook

Twitter

Twitter

Linkedin

Linkedin

Google +

Google +